- Plaza Tower, East Kilbride, Glasgow G74 1LW, United Kingdom

- support@britvestbank.com

- +44 20 3322 1348

- Home

- Services

Current Accounts

- Britvest Bank

- Advance Account

- Student Account

- Bank Account

Britvest Bank Mobile APP

About Us

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo., luctus nec ullamcorper mattis, pulvinar dapibus leo., luctus nec ullamcorper mattis, pulvinar dapibus leo.

- Blog

- Open Account

- Ways to bank

- Mortgages

- Credit Cards

- Contacts

- GET APP

- Home

- Services

Current Accounts

- Britvest Bank

- Advance Account

- Student Account

- Bank Account

Latest News

Britvest Bank Mobile APP

About Us

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo., luctus nec ullamcorper mattis, pulvinar dapibus leo., luctus nec ullamcorper mattis, pulvinar dapibus leo.

- Blog

- Open Account

- Ways to bank

- Mortgages

- Credit Cards

- Contacts

- GET APP

Credit Cards

At Britvest Bank, we don’t just offer a credit card — we offer access to a financial tool that reflects your lifestyle, status, and ambition.

-

GETTING STARTED

-

OVERVIEW

-

COMPARE ACCOUNTS

-

FAQS

💳 Introducing the Britvest Bank Credit Card

Global Power. Executive Privilege. Seamless Spending.

At Britvest Bank, we don’t just offer a credit card — we offer access to a financial tool that reflects your lifestyle, status, and ambition.

The Britvest Credit Card is designed for individuals and business clients who demand performance, security, and recognition wherever they go. Whether you’re traveling, investing, or managing international business, our card empowers you with exclusive benefits, flexible spending, and global confidence.

🏦 Why Choose the Britvest Credit Card?

🌍 Global Acceptance

Accepted at millions of locations in over 200 countries and territories, our card gives you the freedom to transact wherever your ventures take you.

💼 Tailored for Investors & Executives

With premium account limits, business-ready features, and customizable controls, this card was designed for entrepreneurs, investors, and professionals with complex financial needs.

🔒 Advanced Security & Real-Time Control

EMV chip & contactless NFC

Instant transaction alerts

Freeze/unfreeze via online banking

Two-factor authentication and fraud monitoring

✈️ Travel & Lifestyle Benefits

Complimentary airport lounge access

Global concierge support

Travel insurance coverage

Luxury hotel and car rental privileges

💳 Flexible Credit Options

Adjustable limits based on financial profile

Deferred payment and low-interest options

Monthly installment plans for large purchases

Dedicated account manager for credit planning

🎯 Ideal For:

High-net-worth individuals

International business travelers

Offshore investors

Corporate executives

Clients seeking premium purchasing power

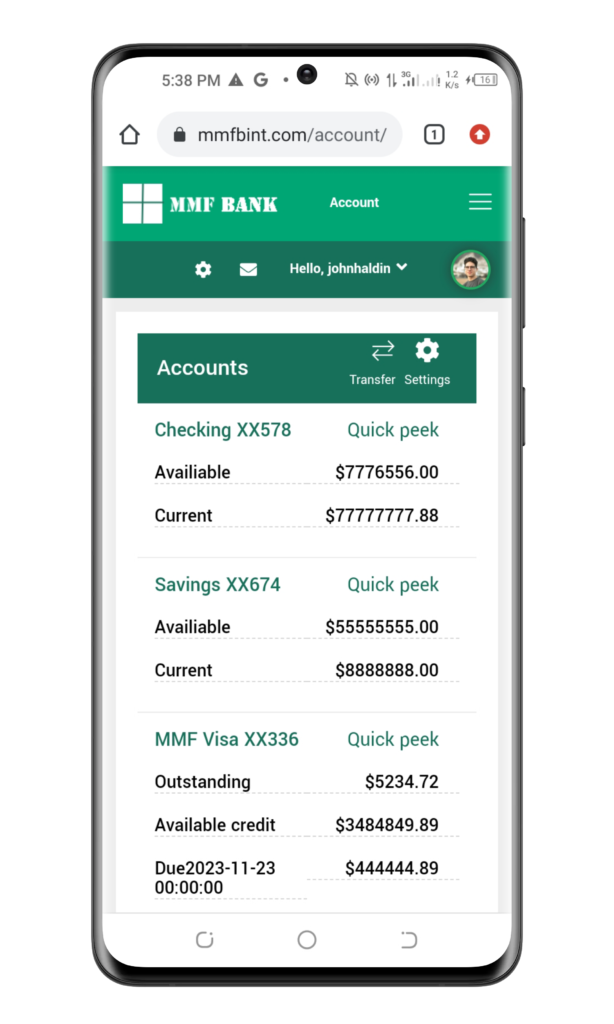

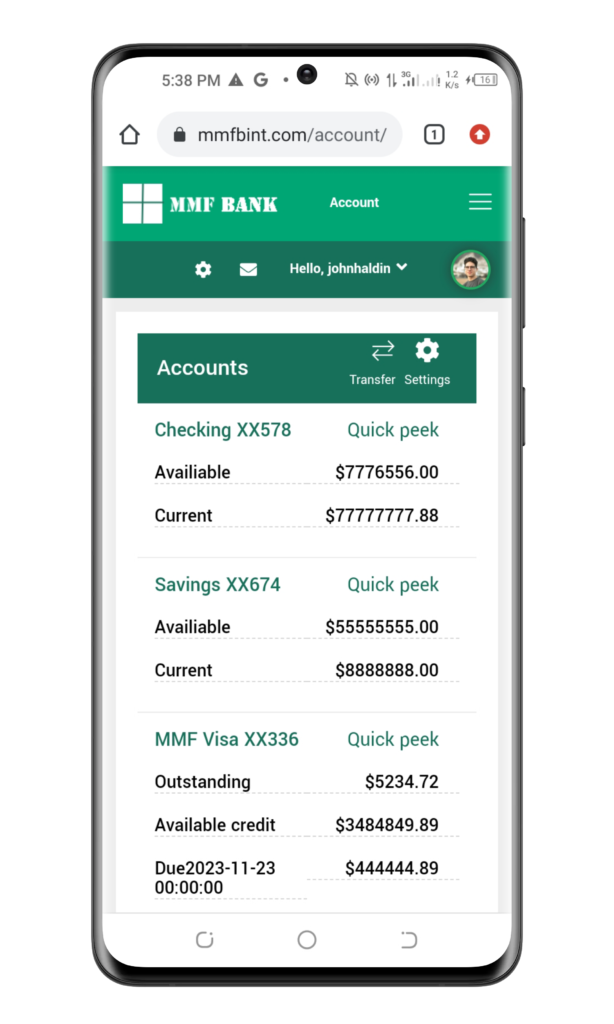

📊 Account Integration

Your card is directly linked with your Britvest Online Banking Portal — making it easy to:

View real-time balances and statements

Track corporate vs. personal expenses

Generate monthly summaries for tax or investment purposes

💠 Additional Perks

Cashback rewards on select global spending categories

Priority assistance via Britvest Private Banking

Optional metal card edition (coming soon)

Access to exclusive Britvest events and partner offers

📝 How to Apply

Applying is simple, secure, and can be done entirely online.

Eligibility:

You must hold an active Britvest account and meet minimum financial profile criteria for premium lending and credit services.

💼 Existing clients can apply directly through their dashboard.

🌐 New clients may begin by opening a Britvest Bank account.

💬 Still Have Questions?

Our Relationship Advisors are available to help you find the right credit solution for your goals. Contact us for a private consultation or apply online today.

📞 Call: +44 20 3322 1348

📧 Email: cards@britvestbank.com

🔐 Login to Client Portal

Britvest Bank. Power Your Lifestyle. Finance Your Future.

Features

$0

Maintenance Fee

Yes

Interest Bearing

Yes

Temporary Lock

Britvest Bank Basic Card

- $200 online cash rewards bonus offer and 3% cash back in the category of your choice.

- Earn unlimited 1.5% cash back on all purchases.

- No limit to the amount of cash back you can earn and cash rewards don’t expire. Calculate rewards

- Introductory 0%† APR for your first 15 billing cycles for purchases, and for any balance transfers made within 60 days of opening your account. After that, a Variable APR that's currently 13.99% to 23.99% will apply. 3% fee (min $10) applies to balance transfers.

- Preferred Rewards members earn 25%-75% more cash back on every purchase. That means you could earn up to 2.62% cash back on every purchase. Learn More About Preferred Rewards

- This online only offer may not be available if you leave this page, if you visit a Bank of America financial center or call the bank. You can take advantage of this offer when you apply now.

Features

$0

Maintenance Fee

Yes

Interest Bearing

Yes

Temporary Lock

BBINT Rewards Card

- $200 online cash rewards bonus offer and 3% cash back in the category of your choice.

- Earn unlimited 1.5% cash back on all purchases.

- No limit to the amount of cash back you can earn and cash rewards don’t expire. Calculate rewards

- Introductory 0%† APR for your first 15 billing cycles for purchases, and for any balance transfers made within 60 days of opening your account. After that, a Variable APR that's currently 13.99% to 23.99% will apply. 3% fee (min $10) applies to balance transfers.

- Preferred Rewards members earn 25%-75% more cash back on every purchase. That means you could earn up to 2.62% cash back on every purchase. Learn More About Preferred Rewards

- This online only offer may not be available if you leave this page, if you visit a Bank of America financial center or call the bank. You can take advantage of this offer when you apply now.